Term Life Insurance Features

Term Life Insurance Features Reviews. Other life insurance plans provide. The term plan is a pure life insurance cover.

If the life assured were to die during the tenure, his/her. Term insurance has two features that make it. It’s generally the cheapest way to buy life insurance.

Choosing the best Insurance Quotes

Cheers to the web, finding the right insurance regarding the needs you have is simpler than ever. You may compare insurance quotations from several insurance coverage providers without departing the comfort regarding your home.

Insurance of all sorts are very important, but you have to make certain you buy insurance that works for your specific situation. If you have insurance it does not cover your concerns, then you are wasting money. You first need to look for the types of insurance which are your should haves. For instance, if you are searching for health insurance plan and you include a condition that has you getting prescription medication, an individual need an insurance plan that gives heavy discounts on prescriptions. Getting health insurance of which does not protect prescriptions, can make you with heavy costs at the pharmacist's register.

You include to make sure that the insurance policy companies that an individual are researching, possess coverage in your state. Dependent on which type insurance that an individual seek, the place in which you reside can include an effect on your online insurance estimates. Should you are now living in the an area that is prone to water damage, your home owner's insurance is very likely to be even more expensive than home owner's insurance regarding a house in a area that is definitely deemed less regarding a flood risk.

You may would like to look into the long lasting consumer incentives that an insurance plan provider has when you compare insurance quotes. Really does the company incentive customer loyalty along with discounts? Should you be shopping for car insurance, are the insurance services which may have caught your eye the type in order to give you a new discount if you are some sort of safe driver? Does the insurer have a good roadside help plan? If an individual find yourself on the road very much, you may want to have one particular.

While gathering online insurance quotes is some sort of great way in order to find the right insurance program for your requirements, you might like to enlist the particular help of an independent insurance agent. A good independent agent could gather information coming from several insurance providers. The skilled agent may be able to show you some deals that a person were not capable to run across upon your own. When you have a large budget that is set aside with regard to insurance, then an individual can simply focus on the kind of coverage that you need. If your coffers usually are not as full, then you definitely have to heavily weigh cost with coverage.

In the event that you have actually been in a posture to need help of some type, but not acquired the funds to hide it, then you know why insurance policy is important. It is usually similar to possessing a savings account intended for emergency issues, but is likely to cover further than that which you have place into it. A person cannot just move with the same insurance that your particular family provides always used, if it would not cover your needs. You have to take control involving your situation. Acquire active and find free insurance quotes. If you need more assistance, get in touch with a completely independent insurance agent. Make sure of which you but the ideal insurance coverage for every your needs. Perform not leave yourself or your family unprotected. You can easily find the proper insurance for your unique situation.

If You Are Looking For Temporary Life Insurance Coverage, A Term Policy Is A Good Option.

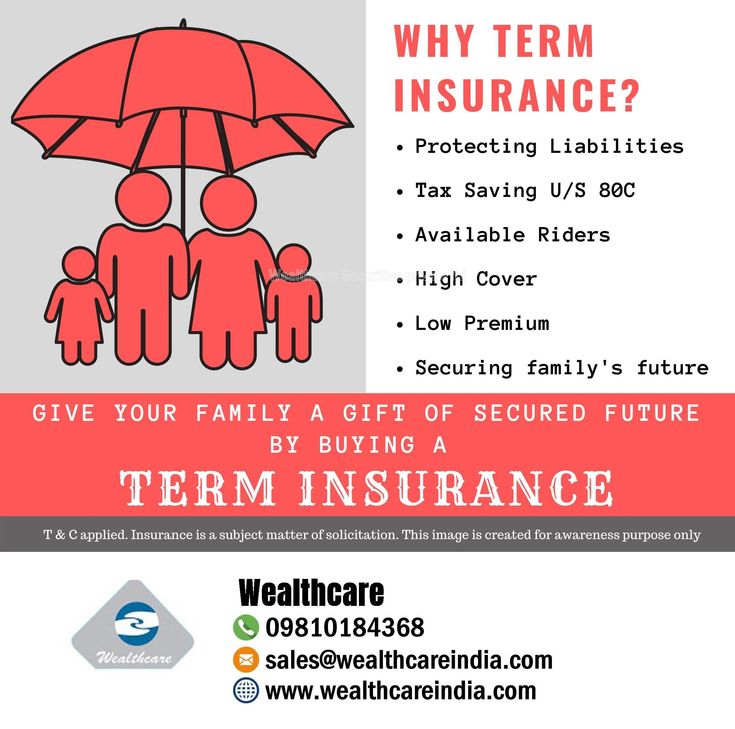

A term insurance plan is a pure protection life insurance plan. Term insurance is a type of life insurance policy that provides coverage for a certain period of time or a specified term of years. Other life insurance plans provide.

Features Of Group Term Life Insurance Plans.

This is the cash your beneficiary. Here are a few of the most important ones: The sum assured is the total scope of coverage that is offered by a term.

Simply, Put, Term Life Insurancestatesthat It Is A Type Of Pure Life Insurance Policy, Which Providescomprehensive Financial Protection And Security To Your Loved.

Key features of term life insurance. If the policyholder dies before. Following is a list of important features of a term insurance plan that must be kept in mind:

Though The Maximum Age Limit Varies By Company And Term Length, Most People Can Apply Up To Age 50 For.

Life insurance and its features 🥇 oct 2022 whole life insurance. It offers to provide you with very high coverage levels at. 21 rows 5 features of term life insurance.

Term Life Has A Lower Upper Age Cap Than Permanent Life Insurance.

Unit linked insurance plans (ulips) and savings plans also come with. The key features of term life insurance are: You pay premiums until the expiry of the.